Navigating liability claims can feel hard if you lack legal and insurance knowledge. You must learn the steps to file or manage claims well. This guide explains the steps you need so you handle claims with clear and simple actions.

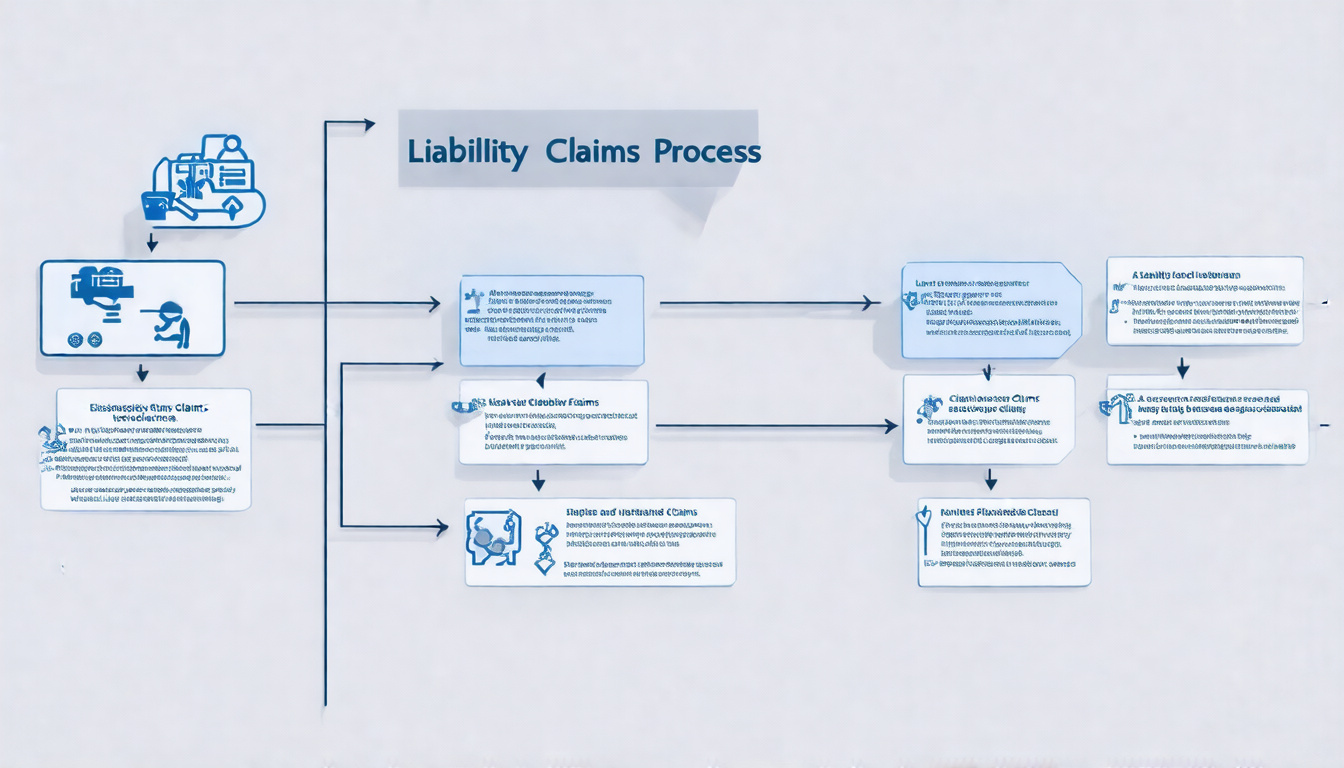

What is the Liability Claims Process?

The liability claims process is a set of steps you use when you file a claim for injury or damage. In cases like car accidents, injuries on property, or product defects, one party may be held responsible. You file a claim, you negotiate a settlement, or you may go to court. Doing these steps well helps you keep your rights safe and get fair compensation.

Step 1: Identify Liability and Gather Evidence

Every claim must show who is at fault. If you deserve compensation, you need to:

- Find the responsible party: This may be a person, a business, or another group whose actions brought harm.

- Gather evidence: Take photos, record videos, get witness statements, secure medical records, and keep police reports.

- Record details: Save all expenses, messages, and timelines that link to your claim.

By gathering evidence closely and clearly, you make the connections strong and speed up the claims process.

Step 2: Notify the Responsible Party or Their Insurer

After you show who is liable and collect your evidence, you must inform the responsible party or their insurer. This step starts the claim process. To act correctly, you should:

- Follow any rules set in your policy or contract.

- Send a written notice that describes the incident, lists any injuries or damage, and states your plan for compensation.

- Keep copies of all messages for yourself.

Notifying them quickly and clearly helps avoid delays and builds trust when discussing a settlement.

Step 3: Submit the Claim and Documentation

Filing the claim is when you share your case details with the insurer or an adjuster. You must include:

- A completed claim form, if one exists.

- A clear statement that shows how the injury or damage happened.

- Evidence like photos, witness statements, bills, repair estimates, and receipts.

- Proof of your loss, such as lost income, property damage bills, and records of pain and suffering.

By keeping your documentation short and simple, you strengthen your proof and help the insurance company review it faster.

Step 4: Engage in the Investigation and Evaluation

After you file a claim, the insurer or other party inspects your claim. They look to see who is at fault and how much damage you have. This stage includes:

- Reviewing all the evidence you gave.

- Asking for witness statements.

- Checking the damage or reading medical reports.

- Calling in experts if needed.

During this step, answer questions clearly and keep all replies short. Do not share extra details that might confuse the claim.

Step 5: Negotiate a Settlement or Prepare for Litigation

Many claims end through negotiation rather than in court. After they review your case, you might get a settlement offer. When you reply, you should:

- Compare the offer to the damage you can prove.

- Think about hiring a lawyer before you accept.

- Ask for an amount that covers all your losses.

If you cannot reach a fair offer, you may need to start court actions by filing a lawsuit and following steps like discovery, mediation, and trial.

Tips for Success in the Liability Claims Process

To work well through your claim, keep these ideas in mind:

- Act quickly: Many claims have strict time limits.

- Stay organized: Keep all bills, documents, and messages in one place.

- Be honest and clear: False details can hurt your claim.

- Get professional help: A lawyer or claims expert can guide you.

- Know your rights: Read your insurance policy well to understand your coverage.

Frequently Asked Questions About the Liability Claims Process

Q1: How long does the liability claims process usually take?

A: The time can change with each case. Simple claims may finish in weeks, while harder cases can take months or even years, especially if court is required.

Q2: What types of damages can I claim in a liability process?

A: You can claim costs like medical bills, lost wages, and repair expenses. You can also claim non-economic damages like pain and suffering or emotional distress.

Q3: Can I handle the liability claims process without a lawyer?

A: Yes, you can manage many claims yourself. Yet, for difficult cases, hiring a lawyer can help you get better results and protect your rights.

Authoritative Insight

The Insurance Information Institute tells us that knowing your policy and working fast with your insurer is key to a smooth claim (source).

Final Thoughts: Take Control of Your Liability Claims Process Today

Mastering liability claims gives you power over your rights and helps you gain fair compensation quickly. Whether you file a claim for yourself or manage one for a business, a clear step-by-step path makes the process less stressful. Remember to record everything, act fast, and get expert advice when needed. Start taking control today to change a difficult situation into a manageable one.

Author: Doyle Weaver, Attorney at Law

Home | Estate Planning | Personal Injury | Hill Country Lawyer | Terms of Service | Privacy Policy

© 2025 Digital Law Firm, P.C.

Disclaimer: The content provided in this blog is for educational and informational purposes only. It is not intended to constitute legal advice or establish an attorney-client relationship. The information presented does not address individual circumstances and should not be relied upon as a substitute for professional legal counsel. Always consult a qualified attorney for advice regarding your specific legal situation. The author and publisher are not liable for any actions taken based on the content of this blog.

Leave a Reply